License Fee Collection Last Updated on : Jan 23, 2026

License Fee Collection Last Updated on : Jan 23, 2026

Spectrum Usage Charges CollectionLast Updated on : Jan 23, 2026

Spectrum Usage Charges CollectionLast Updated on : Jan 23, 2026

Hon'ble Union Minister

Shri Jyotiraditya M. Scindia

Hon'ble Minister of State

Dr.Pemmasani Chandra Sekhar

License Fee Assessment HandbookDownload  (43.9 MB)

(43.9 MB) ![]()

Key orders on review of Bank Guarantee Download  (0.6 MB)

(0.6 MB) ![]()

NEFT/RTGS payment process via SARAS updated w.e.f. 22.02.2025 Download  (0.7 MB)

(0.7 MB) ![]()

Amendment in DVR SOP- Timeline regarding- dated 25.7.2024. Download  (0.7 MB)

(0.7 MB) ![]()

2023-24 Q1 DVR submission date extended till 31.10.2023. Download  (0.1 MB)

(0.1 MB) ![]()

Representations on review of Definition of GR and AGR letter to DOT units Download  (0.1 MB)

(0.1 MB) ![]()

Representations on review of Definition of GR and AGR letter to Industry Associations Download  (0.1 MB)

(0.1 MB) ![]()

SECOND COMPENDIUM-REVENUE MATTERS Download  (27.2 MB)

(27.2 MB) ![]()

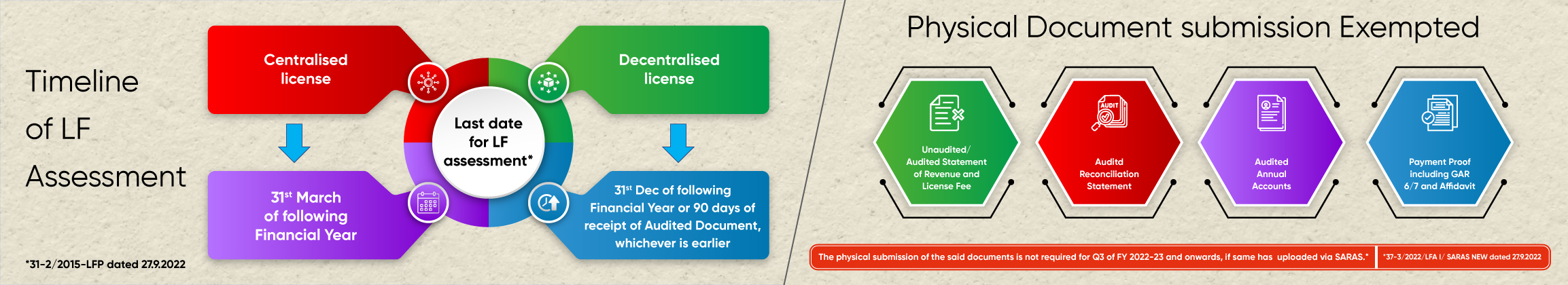

Timeline for License Fee Assessment Download  (2.4 MB)

(2.4 MB) ![]()

Revamped SARAS Helpdesk Download  (0.4 MB)

(0.4 MB) ![]()

Standard Operating Procedure for surplus (SOP for Surplus) Download  (0.2 MB)

(0.2 MB) ![]()

Letter for Removal of Physical Document (LFA) Download  (0.1 MB)

(0.1 MB) ![]()

Standard Operating Procedure for Deduction Verification (SOP for DVR) Download  (0.8 MB)

(0.8 MB)

Clarification regarding Cumulative/Presumptive/Negative AGR. Download  (1.1 MB)

(1.1 MB)

Clarification regarding Surplus Adjustment of LF and SUC. Download (0.5 MB)

(0.5 MB)

Supreme Court Judgement dated 01.09.2020 in M.A. no. 9887 of 2020 in C.A. no. 6328-6399 OF 2015 Download (0.5 MB)

(0.5 MB)

In case of any shortfall or delay in payment by the Licensee, will there be any interest applicable?